Philippines

Empower Global provides outsourcing to the Philippines for customers that want to hire employees and run payroll without first establishing a branch office or subsidiary in the Philippines. Your candidate is hired by Empower Global in accordance with local Philippine labor laws and can be onboarded in days instead of the months it typically takes. The individual is assigned to work on your team, working on your company’s behalf exactly as if he or she were your employee to fulfill your in-country requirements.

Empower Global provides offshore staffing for companies that want to hire employees in the Philippines without first establishing a branch office or subsidiary in the Philippines. Your candidate is hired by Empower Global in accordance with local labor laws and can be onboarded in days instead of the months it typically takes. The individual is assigned to work on your team, working on your company’s behalf exactly as if he or she were your employee to fulfill your in-country requirements.

Table of Contents

Hiring in the Philippines

Employment Contracts in the Philippines

Working Hours in the Philippines

Holidays in the Philippines

Vacation Days in the Philippines

Philippines Sick Leave

Maternity/Paternity Leave in the Philippines

Health Insurance in the Philippines

India Supplementary Benefits

Termination/Severance in the Philippines

Philippine Payroll

Paying Taxes in the Philippines

Why Empower Global?

Hiring in the Philippines

The Philippines has a strong community culture where the employer looks after and provides for its employees; it’s an extremely kind and cordial culture. When recruiting employees in the Philippines, listen to the intention behind their words and recognize the subtleties to establish a positive and happy work environment.

Companies that are hiring in the Philippines should keep in mind that while costs and salaries are lower in the Philippines, cutthroat office environments are not very successful. Filipinos especially appreciate a pleasant work atmosphere. Many of our contemporaries in the Philippines report that having colleagues that appreciate each other’s work and treat each other in a friendly, cordial manner, goes much further than higher pay to retain employees.

Employees often negotiate in terms of net salary rather than gross salary. This can create difficulties for US employers, who are used to negotiating in terms of gross salary. When negotiating with a candidate in the Philippines, make sure to clarify that all offers are stated in terms of gross rather than net salaries.

When negotiating terms of an employment contract and offer letter with an employee in the Philippines, it may be useful to keep the following standard benefits in the Philippines in mind:

Employment Contracts in the Philippines

In the Philippines, employment contracts can be oral or written, but it is common to provide a written contract in English, which spells out the terms of the employee’s compensation, benefits, and termination requirements. An offer letter and employment contract in the Philippines should always state the salary and any compensation amounts in the Philippine Pesos rather than a foreign currency. Professionals engaged via Empower Global have entered into a locally compliant employment contract with Empower Global.

The Labor Code draws a distinction between Managerial and Non-Managerial (Rank-and-File). Rank-and-File Employees are entitled to statutory benefits under the Labor Code which Managerial Employees are not.

Rank-and-File employees are entitled to certain labor benefits and privileges (i.e., night shift differential, overtime pay, pay for work rendered during rest days or holidays, annual service incentive leave pays of 5 days, and service charges.)

Nonetheless, Philippine labor laws do not prohibit employers from granting such benefits and privileges to a managerial employee, provided, that such entitlement is agreed upon in writing by the employer and the managerial employee.

Working Hours in the Philippines

The Philippine workweek is 40 hours, with a standard workday of 8 hours. If employees in the Philippines must work on a weekend, they are entitled to an additional 130% of their regular daily rate wages, unless the collective bargaining agreement or employment contract states differently.

If the employee works more than 8 hours a day the employer must pay an additional 125% of the hourly rate in excess. Employers in The Philippines may not provide compensation in time off rather than wages.

Holidays in the Philippines

There are two types of holidays in the Philippines: Regular Holidays and Special Non-Working days. Regular holidays are paid days off, and if the employee works during regular holidays they are required to be paid an additional 100% of their regular daily rate wages. Special Non-Working days are also paid holidays, and if the employee is required to work on these days, they are paid an additional 30% of their regular daily rate wages. There are some additional regulations around special pay for overtime and normal rest days.

The number of Regular & Special Non-Working Holidays in a year may vary depending on the government’s regulations but the usual holidays observed are the following:

Regular Holidays

New Year’s Day

Araw ng Kagitingan

Maundy Thursday

Good Friday

Labor Day

Eid’l Fitr (Tentative)

Independence Day

Eid’l Adha (Tentative)

National Heroes Day

Bonifacio Day

Christmas Day

Rizal Day

Special Non-Working Days:

Chinese New Year

EDSA People Power Revolution

Black Saturday

Ninoy Aquino Day

All Saints Day

Feast of the Immaculate Conception of Mary

Philippines Sick Leave

There is no statutory sick leave above what is mentioned above in The Philippines. That being said, employee contracts, company policy, and collective bargaining agreements often include sick leave benefits.

An employee who has paid at least three monthly Social Security contributions in the 12 month period prior to the illness or injury, is confined for more than three days in a hospital or elsewhere, and has the approval of the SSS, is entitled to be paid by his employer at 90% of his average daily salary per day of confinement, but only after all sick leave with pay due from the employer has been exhausted. The employer is entitled to 100% reimbursement from SSS. The employee must submit directly to SS to receive reimbursement.

Maternity/Paternity Leave in the Philippines

A female member of the Social Security System (SSS) who has paid at least 3 monthly contributions in the twelve-month period immediately preceding the semester of her childbirth or miscarriage shall be paid a daily maternity benefit equivalent to 100% of her average daily salary. This benefit is for 105 days for live birth, regardless of delivery method, and 60 days for miscarriages or emergency termination of pregnancy. Such benefit is available for every instance of pregnancy, miscarriage, or emergency termination.

Married male employees are eligible for seven days of paid paternity leave for their first four children, as long as they live in the same household. Leave must be taken within 60 days of the birth.

Health Insurance in the Philippines

The Philippines has compulsory universal healthcare which is funded through payroll taxes and the general budget. Private health care is also available. The Private Healthcare system caters to 30% of the population.

Many employers offer benefits for private medical insurance. We recommend a taxable allowance in the amount of US$300 to US$600 to cover the cost of a private medical plan. Occasionally the individual needs assistance finding a plan since they may not have the know-how to find and select a plan.

Bonuses

Filipino employees are legally entitled to a 13th-month salary. This is equivalent to 1/12 of the basic salary received by an employee during the year. If a Filipino employee worked for less than a year (regardless of the cause for the termination of his employment), the amount due to him is determined by dividing the total salary he received by the number of months he was employed. The calculation of the base salary does not include allowances and monetary benefits that are not considered or integrated as part of the employee’s regular compensation. If, however, these benefits are by company practice or policy treated as part of the basic salary, then they should be included in the computation of an employee’s 13th-month pay.

Filipino law requires that the extra pay be given no later than December 24th, however, it is strongly recommended that the 13th month salary be paid as early in December as possible. Culturally, the Christmas holiday is very important to Filipinos and the 13th month pay is typically used to buy Christmas gifts. The earlier in December an employer can provide 13th month pay for its Filipino employees, the more the employees will appreciate it. Not usual, but sometimes this is given ½ in June. This is a small bonus to cover employees’ children’s school fees are due at the start of the school year (June).

In addition to the 13th month pay, some employers give an additional Christmas bonus, which is known as the 14th month pay. This is one of the key benefits used to attract and retain staff and is highly appreciated by future employees.

Termination/Severance in the Philippines

Filipino termination law is very complicated. Below is a brief summary of the major points.

Probationary employment is allowed for up to six months.

Employers may dismiss workers for just cause, in which case there no mandatory severance. Management must conduct an investigation and have strong evidence to prove cause. Termination causes that would be deemed just cause include:

- serious misconduct

- willful disobedience

- gross and habitual neglect of duty

- fraud or breach of trust

- commission of a crime or offense against the employer, his family or representative

Or for authorized causes the employer must pay a severance. Termination causes that would be deemed authorize cause include:

- installation of labor-saving devices redundancy

- retrenchment to prevent losses

- closure and cessation of business

- disease or illness

In a termination for just cause, due process involves the two-notice rule, that in total legally must be at least 30 days:

- A notice of intent to dismiss specifying the grounds for termination, and giving said employee reasonable opportunity within which to explain his or her side

- A hearing or conference where the employee is given opportunity to respond to the charge, present evidence or rebut the evidence presented against him or her

- A notice of dismissal indicating that upon due consideration of all the circumstances, grounds have been established to justify termination.

In a termination for an authorized cause, due process means a written notice of dismissal to the employee specifying the grounds at least 30 days before the date of termination. A copy of the notice shall also be furnished to the Regional Office of the Department of Labor and Employment (DOLE) where the employer is located.

Employees may appeal to an arbitrator and if the employer is found not to have followed the correct procedures, the employee may be entitled to payment of damages, reinstatement, and/or back wages.

Severance pay is provided based on the reason for termination, but is typically one month’s wages for every year worked.

In case of termination due to the installation of labour-saving devices or redundancy, the worker affected thereby shall be entitled to a separation pay equivalent to at least his one (1) month pay or to at least one (1) month pay for every year of service, whichever is higher. This is based on what salary the employee received on their most recent check (this includes allowance and basic salary, not commission or bonus).

In case of retrenchment to prevent losses and in cases of closures or cessation of operations of establishment or undertaking not due to serious business losses or financial reverses, the separation pay shall be equivalent to one (1) month pay or at least one-half (1/2) month pay for every year of service, whichever is higher. A fraction of at least six (6) months shall be considered one (1) whole year.

Paying Taxes in the Philippines

Similar to social security in the United States, the Philippines has a social security system which is a mandatory employee benefit. The Philippines Social Security System consists of the following:

- Social Security System (SSS): the SSS was created to provide private employees and their families with protection against disability, sickness, old age, and death. All persons under the age of 60 who earn income from employment of more than P1,000 per month are required to contribute to the SSS. Employee contributions for social security are deducted from employee’s salary payments. These are withheld by the employer on a monthly basis.

- Home Development Mutual Fund (HDMF): the HMDF is a provident savings system providing housing loans to private and Philippine government employees, and to self-employed persons who elect to join the Fund.

- Philippine Health Insurance Corporation (PhilHealth): PhilHealth is administered by the Philippine National Health Corporation, which is designed to provide employees with a practical means of paying for adequate medical care in the Philippines.

Employers in the Philippines are required to make contributions to the above funds.

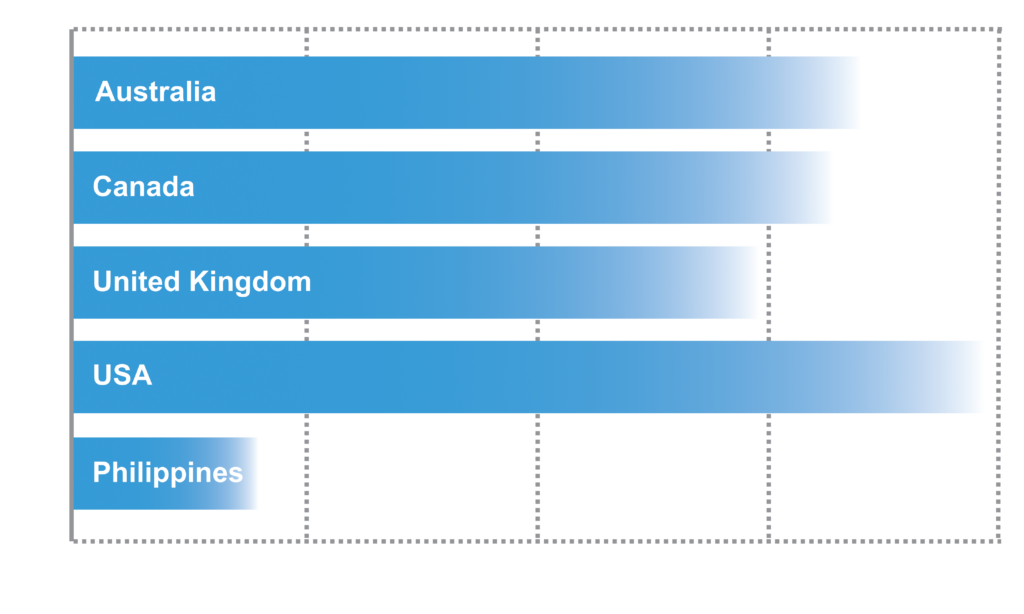

United States

United Kingdom

Canada

Philippines

Australia

India

Luxembourg

Copyright © 2024 Privacy Policy Terms of Use